The Power of a Roth IRA

Are you looking for a retirement savings account that can provide significant benefits and help you achieve your financial goals? If so, you may want to consider opening a Roth IRA. I highly encourage people to explore the advantages of a Roth IRA as part of their retirement planning strategy. One of the most significant benefits of a Roth IRA is the power of compound interest and exponential growth. By contributing regularly and letting your investments grow over time, you can potentially earn significant returns on your contributions, which can help you build wealth and achieve your retirement savings goals.

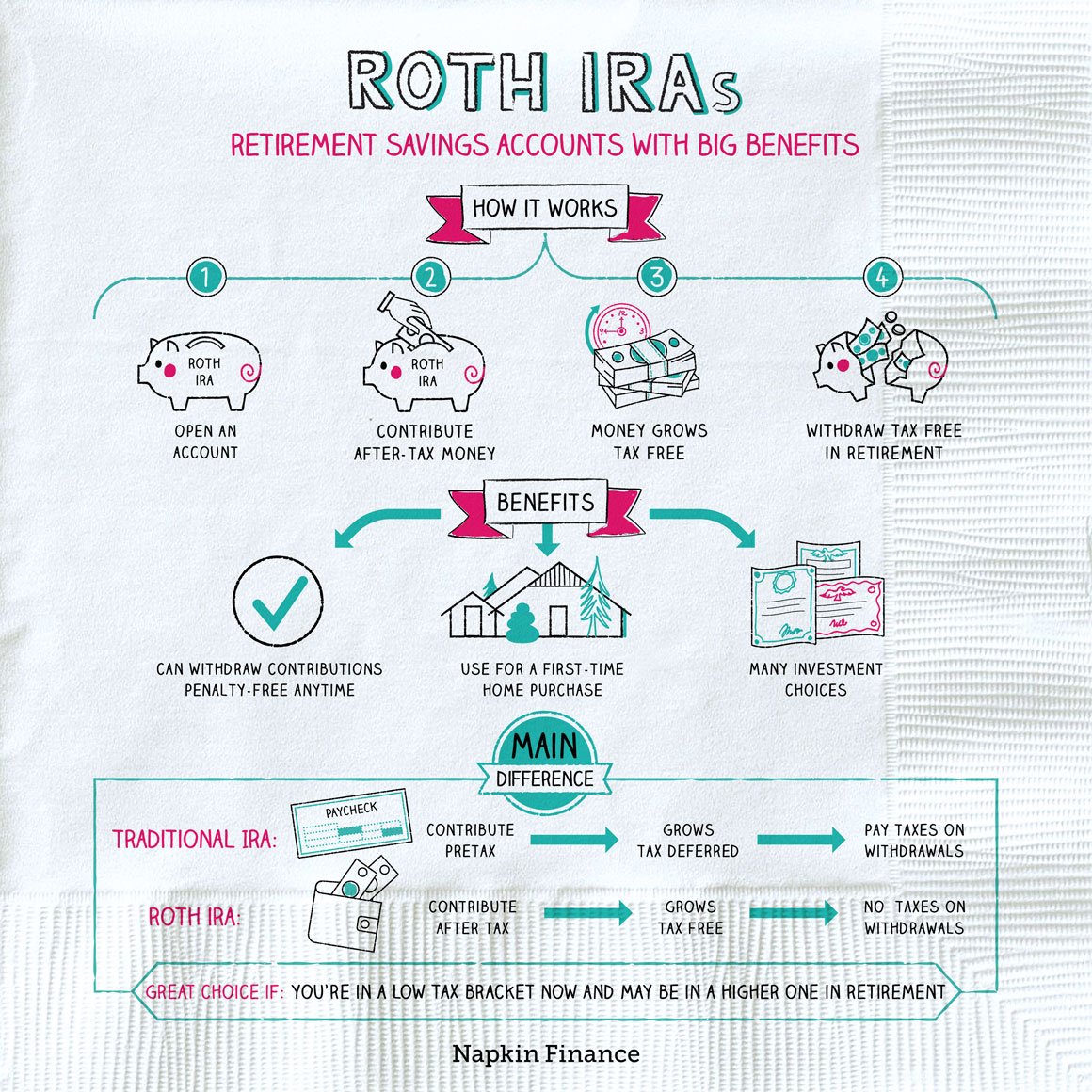

A Roth IRA is a type of individual retirement account that allows you to contribute after-tax dollars. This means that you won't receive a tax deduction for your contributions like you would with a Traditional IRA, but you also won't pay taxes on your withdrawals in retirement. Learn more about the differences between a Roth IRA and a Traditional IRA here. The Roth IRA can be a significant advantage, as it allows your contributions to grow tax-free over time, potentially resulting in significant savings in retirement.

One of the most significant advantages of a Roth IRA is the power of compound interest and exponential growth. Compound interest is the interest earned on both your contributions and the interest you've already earned. This means that your account can grow exponentially over time, resulting in potentially significant savings in retirement. For example, if you were to contribute $5,000 per year to a Roth IRA for 30 years and earn an average annual return of 7%, you would have over $400,000 saved for retirement. And because Roth IRA withdrawals are tax-free, all of that money would be yours to keep.

Furthermore, a Roth IRA is the tax-free treatment of qualified withdrawals in retirement. Unlike traditional IRAs and 401(k) plans, where you pay taxes on your contributions and your withdrawals in retirement, a Roth IRA allows you to pay taxes on your contributions upfront and then withdraw your money tax-free in retirement. This means that you won't have to worry about paying taxes on your withdrawals, which can result in significant savings over time. Plus, because Roth IRA contributions are made with after-tax dollars, you can withdraw your contributions at any time without penalty or taxes. Overall, the tax-free treatment of a Roth IRA can make it a powerful retirement savings tool that can help you build wealth and achieve your financial goals.

In conclusion, a Roth IRA is a powerful retirement savings tool that can provide significant benefits for those looking to build wealth and achieve their financial goals. By contributing regularly and taking advantage of the power of compound interest and exponential growth, you can potentially earn significant returns on your contributions and build a valuable source of tax-free income in retirement. The tax-free treatment of qualified withdrawals in retirement, lack of required minimum distributions, flexible contributions, and estate planning benefits make the Roth IRA a valuable addition to any retirement planning strategy.